Proud mom alert: since this is graduation weekend AND Mother’s Day, the Launch Lady is beaming with pride and brimming with gratitude. I bring you good news! College can, indeed, be completed in four years. One of the pictured individuals could have completed it in 3, but they chose to accept an extended internship and take a lighter load in year 4 (he knows who he is). The other one graduated from community college before transferring to University of Illinois (she knows who she is). I have known one of them since the day of her birth, and have had the privilege of watching the other one grow over the last 5 years. Is there a secret ingredient to completing college on schedule? Well, following are a few of the behaviors I witnessed and the observations that I have made:

Planning begins in high school If your local high school has dual credit or Advanced Placement courses, encourage your teen to take advantage of them. It’s an awesome opportunity to begin college with one or more semesters already completed, tuition free!

Become involved in extracurricular and civic activities. Not only does this provide excellent networking opportunities, but it helps create a well-rounded student. Another bonus is that the experience enriches and provides interest to the content of scholarship applications.

Apply relentlessly for scholarships. Both received multiple scholarships. Setting a goal of applying at least once per week greatly increases the odds of winning. There is plenty of free money to be awarded and it is not all need based. Scholarship applications are not a waste of time even if they do not win. The ubiquitous essays are good practice for selling oneself; much like the skills that will be needed to write a cover letter and resume.

Start by taking the prerequisites first at a local community college. Work closely with counselors to determine which ones will most likely transfer. Tuition will be lower and room and board free since they will probably still be living at home.

Maximize the classes taken each semester. Some colleges charge a fixed price for full time students. As a result, you can take 18 credits for the same price as 12 credits. A consistent 16 credits per semester will achieve a 4-year graduation goal. It may be worth it to forfeit the part time job during school if it can save another full year of tuition, room and board.

Apply for and accept summer internships that are relevant to college major. Not only will it contribute a good sum towards tuition, but it can also provide spending money during the academic year. It may also turn into a full time job after graduation. The very least is that it looks good on a resume and can provide an industry specific reference.

Don’t feel that college has to be done right after high school. Full time employment is sometimes a good idea for the high school graduate who doesn’t know what they want. That is better than stretching out college far past the traditionally allotted time to compensate for changing majors. There are plenty of opportunities for adult learners and they can be done in conjunction with a full time job. I know many who have benefited from this option, including myself. Many companies offer phenomenal tuition benefits to those who are motivated to go to school while working.

I am very grateful to have a daughter who was motivated to get through college within 4 years and I am sure his parents feel the same way. I’d like to think that I helped in some way, but the key ingredient I offered was accountability. One of my greatest gifts is to share in the victory of one of my children. College is over, kids. Time to set some new goals; as soon as you get through the wedding and honeymoon!

Happy Mother’s Day to all of the moms as well as those who fill the role of a mom!

Is disposable income really the devil? Well, it depends on perspective. As an adult with grown up responsibilities such as paying for a mortgage and taking care of a family, disposable income is a wonderful thing which allows us to enjoy discretionary experiences and things. How, then, could disposable income ever be a bad thing you ask? Well, let me tell you! When a teenager or young adult first begins to earn their own money, unless it is offset by some personal responsibility, they have a plethora of disposable income. During this time of abundance, it is very easy to allow poor spending habits to take root. These habits, if allowed to continue, can make them feel persecuted and victimized when real life responsibilities hit and they can no longer have a daily treat from Starbucks, eat fast food, go to concerts and movies or buy video games frequently. Following are some ideas to help them learn to manage their income while learning incremental financial responsibility:

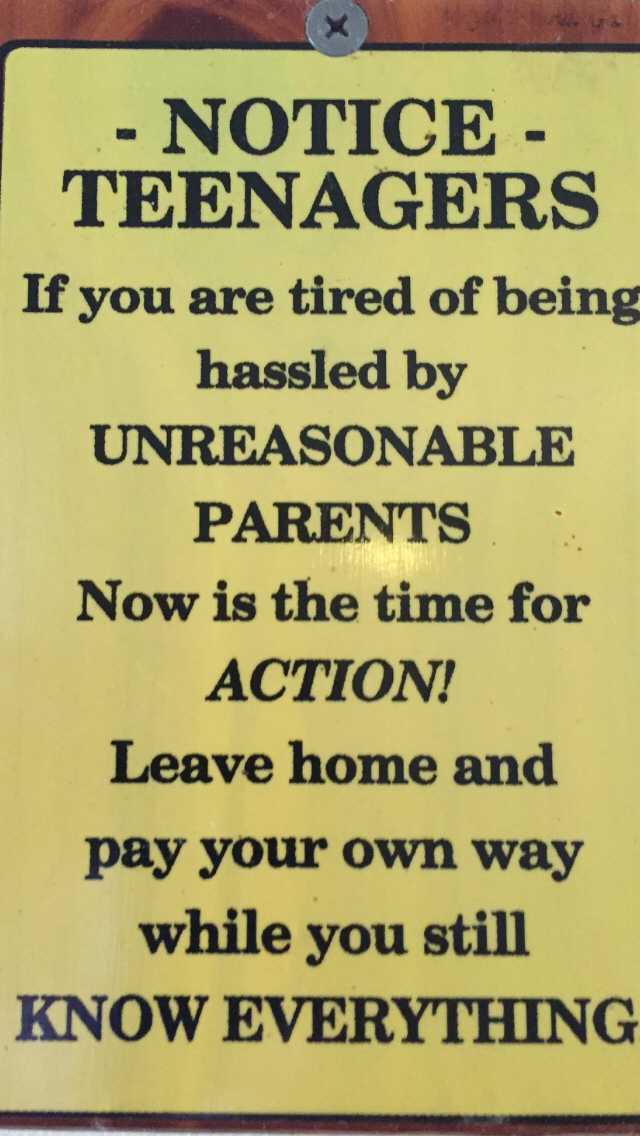

Is disposable income really the devil? Well, it depends on perspective. As an adult with grown up responsibilities such as paying for a mortgage and taking care of a family, disposable income is a wonderful thing which allows us to enjoy discretionary experiences and things. How, then, could disposable income ever be a bad thing you ask? Well, let me tell you! When a teenager or young adult first begins to earn their own money, unless it is offset by some personal responsibility, they have a plethora of disposable income. During this time of abundance, it is very easy to allow poor spending habits to take root. These habits, if allowed to continue, can make them feel persecuted and victimized when real life responsibilities hit and they can no longer have a daily treat from Starbucks, eat fast food, go to concerts and movies or buy video games frequently. Following are some ideas to help them learn to manage their income while learning incremental financial responsibility: I don’t know who to credit for this snippet of wisdom but I think it is pretty sound advice!

I don’t know who to credit for this snippet of wisdom but I think it is pretty sound advice!